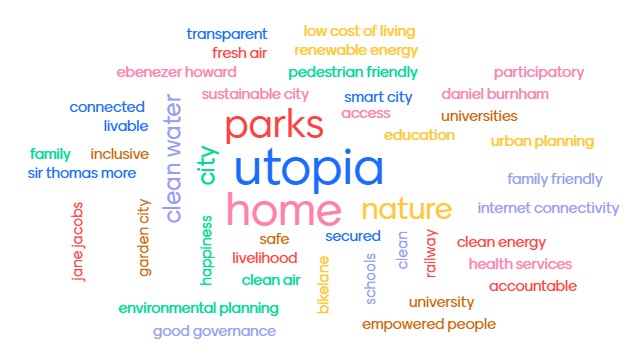

Do you want to be an Urban Planner? Do you think you have the skills and knowledge to become one? Do you want to provide solutions to housing issues, traffic congestion, pollution, flooding, poverty, and other systemic problems? Do you think you have the heart and grit to plan communities, municipalities, and cities? Do you want to become an Urban Planner in the Philippines?

Similar to other professions like doctors, engineers, architects, nurses, teachers, etc.; to become an Urban Planner requires a person to pass a licensure government examination. The Philippine Regulatory Commission (PRC) conducts the examination once a year. Passing the examination would mean a person can practice the profession for the duration of three years (renewable every three years). The person will be a registered professional and may now accept work related to urban planning.

What is Urban Planning? Is it different from an Environmental Planner? Is it different from Town Planning or City Planning in other countries?

There is a Philippine Law that governs the Practice of Urban Planning profession in the country. The law is Republic Act No. 10587 also known as “Environmental Planning Act of 2013”. https://www.officialgazette.gov.ph/2013/05/27/republic-act-no-10587/

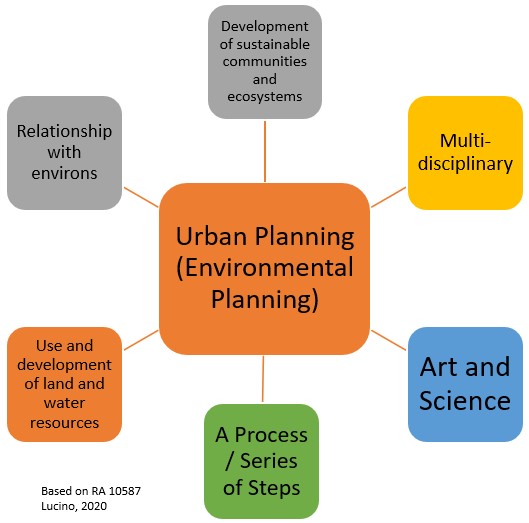

Urban Planning is synonymous with Environmental Planning. It means they are the same in the Philippines alongside regional planning, city planning, town and country planning, and/or human settlements planning. However, Environmental Planning is the term used in Republic Act No. 10587.

“Environmental planning, also known as urban and regional planning, city planning, town and country planning, and/or human settlements planning, refers to the multi-disciplinary art and science of analyzing, specifying, clarifying, harmonizing, managing and regulating the use and development of land and water resources, in relation to their environs, for the development of sustainable communities and ecosystems.” – RA 10587 SEC. 4. (a)

The definition is quite complex and intriguing. I will try to explain the parts of the definition as best as I can as follows:

Multi-disciplinary – This means that there are numerous fields of study, discipline, and professions that make up Urban Planning. Urban Planners come from various professions such as Architecture, Engineering, Public Administration and other Social Sciences, etc. This also means that Urban Planners work in teams. Though in the news, we may hear famous urban planners planning important sites/projects, it doesn’t mean that he/she planned it alone. A reliable team is behind a good masterplan. Issues like pollution, traffic congestion, flooding, etc. need a multi-disciplinary team composed of members from different discipline to analyze and provide viable solutions to these challenges.

Art and Science – Science is a system or collection of knowledge related to Urban Planning. The knowledge is comprised of multi-disciplinary fields of study and discipline. Art is application of this knowledge (Science) in real situations usually providing intervention to current issues, and challenges. Sometimes, a very good plan is shelved because stakeholders does not support or commit to the plan. A good project is sometimes rejected due to political implications. Art and Science in Urban Planning should go hand in hand.

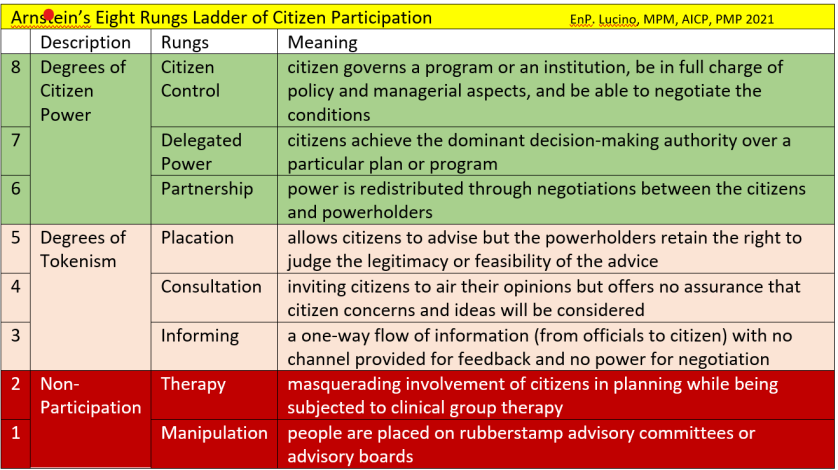

Analyzing, specifying, clarifying, harmonizing, managing and regulating – This shows that Urban Planning is a process. This starts from identifying the issues (present and future) important to stakeholders. This also shows that the team does not provide ready solutions or projects to address an issue. Urban Planners need to analyze the local context or situation and work with stakeholders (support/commitment) in all of the steps of the process. The Planning process should be implemented with, by, and for the stakeholders.

Use and development of land and water resources – Land and water are finite resources. It means that these resources are limited. Land in the countryside is usually used for agriculture (food production) while land in the city is so scarce that buildings (vertical development) are made to accommodate users (residents, commercial, etc.). Land may be used as landfill of solid wastes, housing units, recreational centers, schools and government buildings, factories, etc. Different stakeholders have different ideas (conflicts) on how they will use their land. The Urban Planner make sure that these lands are used judiciously thru the formulation of a Land Use Plan enforced through a Local Zoning Ordinance (Law). Clean Drinking water is also an issue specially in cities wherein they have a remote water source. Over-consumption or wasting of clean water leading to problem in supply affects the health, sanitation, and activities of residents. The Urban Planner should plan carefully on how to secure a sustainable safe water source and ensure pragmatic use of these water resources.

Relation to their environs – Environs are the areas around the site (ex. city) that is being planned. This may be neighboring cities or municipalities, mountainous regions, water bodies, ports, heritage sites, dumpsite, watersheds, etc. The environs provide natural resources and services that affect the planning area. A city beside a denuded mountain will put the city at risk of landslide and flooding. A Barangay beside an ocean is at risk of storm surge during typhoon season. A subdivision project beside a penitentiary will require additional security. An over-extracted or contaminated watershed will affect the water supply of its neighboring towns and cities. Urban Planners plan not only their planning areas but also plans in relation to its environment.

Development of sustainable communities and ecosystems – Sustainable Development in the Brundtland Report is defined as “development that meets the needs of the present without compromising the ability of future generations to meet their own needs.” There are expected conflicts between the needs of the community at present and the needs of the ecosystem (environment). Natural resources serve as source of livelihood, provide protection and other environmental benefits. Some examples are mangroves, forests, watershed, mountains with mineral deposits or infrastructure raw materials, etc.

Extraction of these resources provide livelihood and development to communities. Over-extraction would usually result in increase risk of danger in communities (specially the indigent communities). The role of the Urban Planner is to make sure that communities extract these resources without endangering their lives and properties as well as ensuring that the future generations will also enjoy these resources.

According to Republic Act No. 10587 an “Environmental planner refers to a person who is registered and licensed to practice environmental planning and who holds a valid Certificate of Registration and a valid Professional Identification Card from the Board of Environmental Planning and the Professional Regulation Commission.” Thus, to become an Urban Planner in the Philippines, you must be eligible to take and pass the exam.

I will discuss about the Eligibility Requirements for a person to Qualify to take the Urban Planning Licensure Exam on my next blog. You need to plan your life first (to be eligible for the exam) before you actually plan your community. You may need two to five years (2-5 years) preparation to qualify for the exam depending on your experience and academic background.

Welcome to the World of Urban Planning!

If you are interested to know more about the job / responsibilities of an Urban Planner Click this link – https://cityplanningcoordinator.blog/?p=269

If you want to Know more about the Eligibility Requirement to Qualify to take the Urban Planning Licensure Exam click this link: https://cityplanningcoordinator.blog/?p=286